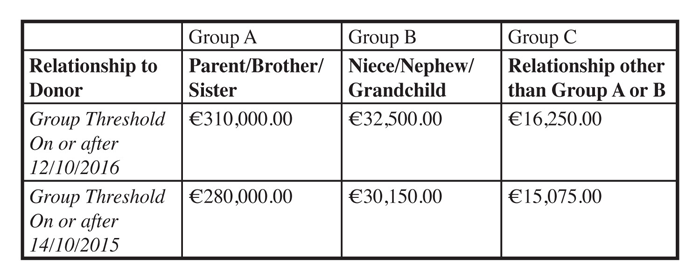

Budget 2016 increased the group thresholds for Capital Acquisitions Tax for all gifts and inheritances from the 11th October, 2016 as follows:

All gifts and inheritances taken by each beneficiary within each class are aggregated from the 5th December, 1991. From the 1st December, 1999 aggregation is limited to aggregation within each group.

There is an annual small gift exemption which remains unchanged at €3,000.00 per individual per year. The €3,000.00 is not subject to aggregation.

Also unchanged is the exemption for gifts of dwellinghouses from disponers to beneficiaries, when the beneficiary lives in the house as his principal place of residence for three years prior to the date of the gift and owns no other residential property.

David Williams